High-rolling investors have positioned themselves bearish on AppLovin (NASDAQ:APP), and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in APP often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 8 options trades for AppLovin. This is not a typical pattern.

The sentiment among these major traders is split, with 25% bullish and 37% bearish. Among all the options we identified, there was one put, amounting to $98,400, and 7 calls, totaling $1,302,490.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $200.0 for AppLovin during the past quarter.

Volume & Open Interest Development

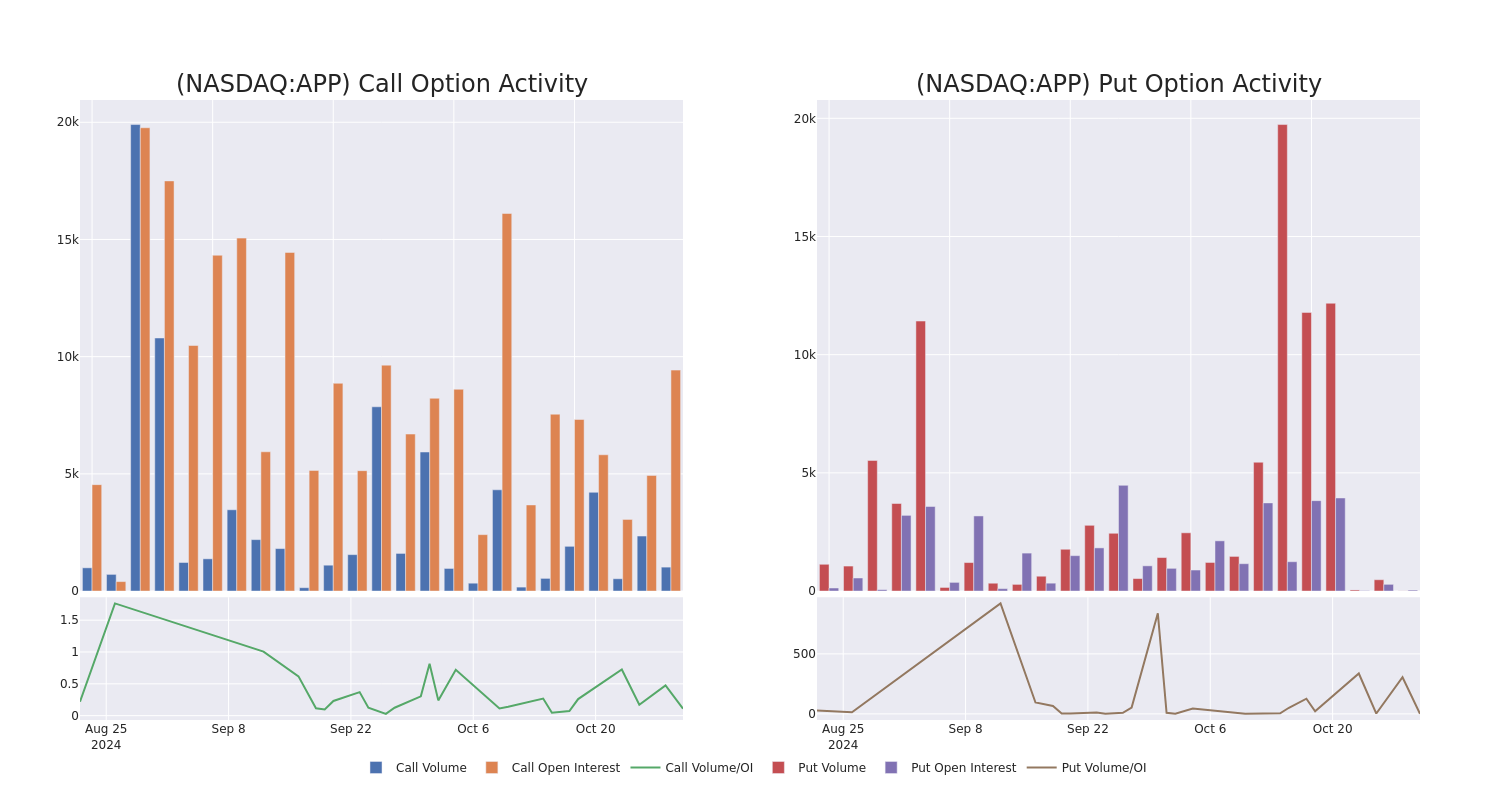

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for AppLovin’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AppLovin’s whale activity within a strike price range from $100.0 to $200.0 in the last 30 days.

AppLovin Option Volume And Open Interest Over Last 30 Days

Are You Taking One of These 9 “Memory Erasing” Prescriptions? [ad]

You may think your memory loss is just a sign of getting older, but one of these 9 drugs could actually be damaging your brain... These 9 prescription drugs have now been linked to Alzheimer's disease diagnoses. If you're over the age of 60, and you're taking even 1 of these 9 drugs, your brain could be at risk. Click here to learn more.

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | CALL | SWEEP | BEARISH | 01/17/25 | $11.1 | $10.7 | $10.7 | $200.00 | $428.0K | 1.1K | 403 |

| APP | CALL | TRADE | BEARISH | 11/01/24 | $69.0 | $66.8 | $66.8 | $105.00 | $260.5K | 40 | 39 |

| APP | CALL | TRADE | NEUTRAL | 01/17/25 | $64.6 | $62.6 | $63.78 | $110.00 | $255.1K | 3.6K | 40 |

| APP | CALL | TRADE | NEUTRAL | 01/17/25 | $74.7 | $72.6 | $73.52 | $100.00 | $220.5K | 3.2K | 30 |

| APP | PUT | TRADE | NEUTRAL | 11/08/24 | $24.8 | $24.4 | $24.6 | $190.00 | $98.4K | 40 | 5 |

About AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company’s software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

In light of the recent options history for AppLovin, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of AppLovin

- Trading volume stands at 304,709, with APP’s price down by -0.46%, positioned at $171.45.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 7 days.

What Analysts Are Saying About AppLovin

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $175.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Wells Fargo downgraded its rating to Overweight, setting a price target of $200.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on AppLovin with a target price of $180.

* An analyst from JP Morgan persists with their Neutral rating on AppLovin, maintaining a target price of $160.

* Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for AppLovin, targeting a price of $185.

* In a cautious move, an analyst from Goldman Sachs downgraded its rating to Neutral, setting a price target of $150.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AppLovin with Benzinga Pro for real-time alerts.