Financial giants have made a conspicuous bullish move on Meta Platforms. Our analysis of options history for Meta Platforms (NASDAQ:META) revealed 13 unusual trades.

Delving into the details, we found 69% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $57,744, and 11 were calls, valued at $1,023,397.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $500.0 to $600.0 for Meta Platforms during the past quarter.

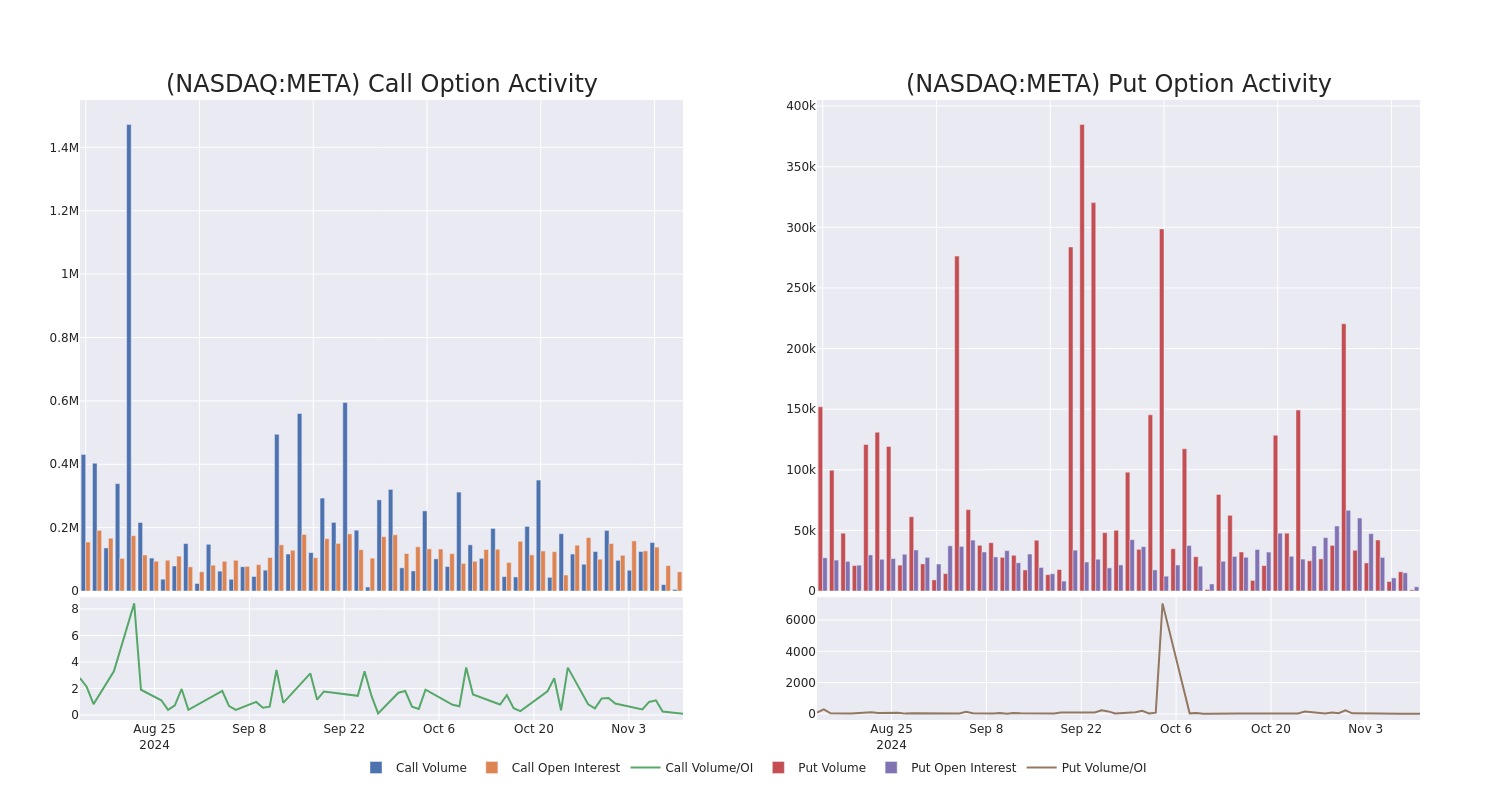

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Meta Platforms’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Meta Platforms’s whale activity within a strike price range from $500.0 to $600.0 in the last 30 days.

Meta Platforms Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

Are You Taking One of These 9 “Memory Erasing” Prescriptions? [ad]

You may think your memory loss is just a sign of getting older, but one of these 9 drugs could actually be damaging your brain... These 9 prescription drugs have now been linked to Alzheimer's disease diagnoses. If you're over the age of 60, and you're taking even 1 of these 9 drugs, your brain could be at risk. Click here to learn more.

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | CALL | SWEEP | BULLISH | 11/22/24 | $16.4 | $16.2 | $16.4 | $570.00 | $332.1K | 1.0K | 632 |

| META | CALL | TRADE | BEARISH | 02/21/25 | $96.65 | $96.05 | $96.05 | $500.00 | $192.1K | 645 | 60 |

| META | CALL | SWEEP | BULLISH | 03/21/25 | $65.5 | $64.95 | $65.33 | $550.00 | $130.6K | 2.9K | 335 |

| META | CALL | SWEEP | BEARISH | 11/15/24 | $8.5 | $8.45 | $8.45 | $577.50 | $61.6K | 776 | 520 |

| META | CALL | SWEEP | BEARISH | 11/15/24 | $2.47 | $2.45 | $2.47 | $600.00 | $57.9K | 11.5K | 775 |

About Meta Platforms

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm’s “Family of Apps,” its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta’s overall sales.

In light of the recent options history for Meta Platforms, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Meta Platforms

- With a volume of 1,487,526, the price of META is down -1.78% at $578.83.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 80 days.

What Analysts Are Saying About Meta Platforms

In the last month, 5 experts released ratings on this stock with an average target price of $682.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Meta Platforms with a target price of $630.

* Consistent in their evaluation, an analyst from Rosenblatt keeps a Buy rating on Meta Platforms with a target price of $811.

* An analyst from B of A Securities has decided to maintain their Buy rating on Meta Platforms, which currently sits at a price target of $660.

* An analyst from Goldman Sachs has decided to maintain their Buy rating on Meta Platforms, which currently sits at a price target of $636.

* An analyst from TD Cowen has decided to maintain their Buy rating on Meta Platforms, which currently sits at a price target of $675.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Meta Platforms, Benzinga Pro gives you real-time options trades alerts.