Investors with a lot of money to spend have taken a bullish stance on Intel (NASDAQ:INTC).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with INTC, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 19 options trades for Intel.

This isn’t normal.

The overall sentiment of these big-money traders is split between 47% bullish and 42%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $48,600, and 18, calls, for a total amount of $1,271,939.

Are You Taking One of These 9 “Memory Erasing” Prescriptions? [ad]

You may think your memory loss is just a sign of getting older, but one of these 9 drugs could actually be damaging your brain... These 9 prescription drugs have now been linked to Alzheimer's disease diagnoses. If you're over the age of 60, and you're taking even 1 of these 9 drugs, your brain could be at risk. Click here to learn more.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $27.0 to $70.0 for Intel during the past quarter.

Analyzing Volume & Open Interest

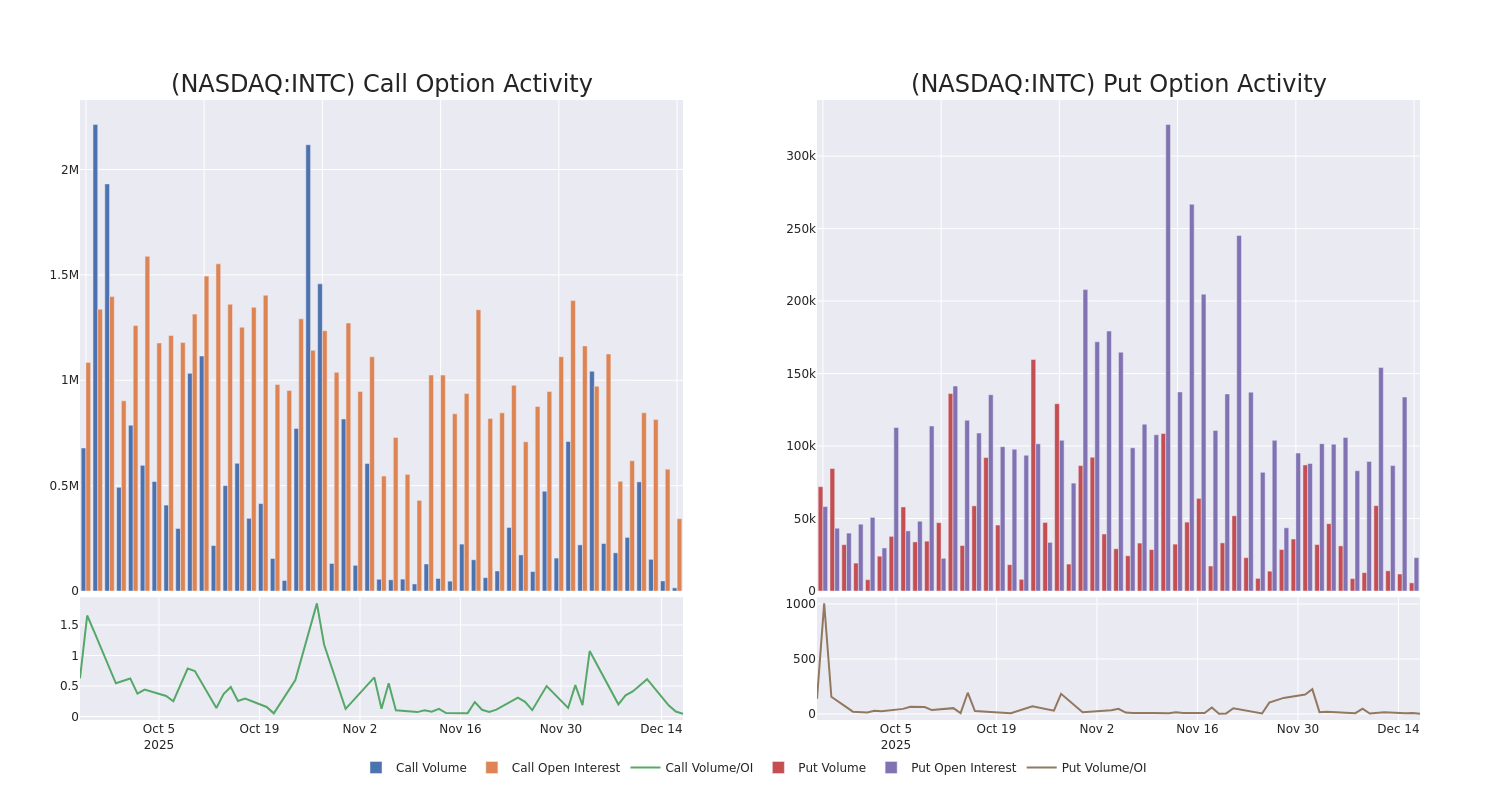

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Intel’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Intel’s substantial trades, within a strike price spectrum from $27.0 to $70.0 over the preceding 30 days.

Intel Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | CALL | TRADE | BEARISH | 01/15/27 | $3.9 | $2.85 | $2.85 | $65.00 | $174.1K | 1.1K | 9 |

| INTC | CALL | TRADE | BEARISH | 03/19/27 | $7.1 | $6.85 | $6.85 | $47.00 | $137.0K | 111 | 0 |

| INTC | CALL | SWEEP | BULLISH | 01/16/26 | $1.17 | $1.14 | $1.17 | $40.00 | $136.7K | 94.3K | 995 |

| INTC | CALL | SWEEP | BEARISH | 01/16/26 | $1.21 | $1.2 | $1.2 | $40.00 | $134.5K | 94.3K | 4.0K |

| INTC | CALL | SWEEP | BEARISH | 01/16/26 | $0.32 | $0.31 | $0.31 | $45.00 | $119.7K | 75.8K | 4.8K |

About Intel

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and led the semiconductor industry down the path of Moore’s law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel is seeking to reinvigorate its chip manufacturing business, Intel Foundry, while developing leading-edge products within its Intel Products business segment.

In light of the recent options history for Intel, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Intel

- With a volume of 9,927,882, the price of INTC is down -1.54% at $36.73.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 43 days.

Expert Opinions on Intel

1 market experts have recently issued ratings for this stock, with a consensus target price of $52.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from KGI Securities has elevated its stance to Outperform, setting a new price target at $52.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Intel options trades with real-time alerts from Benzinga Pro.